Analyst Gartner has put out its latest smartphone market report, and the Q2 2013 numbers show the inevitable finally occurred: smartphone sales exceeded feature phone sales for the first time. Android has been strangling the life out of dumbphones for years, but it looks like the market tipping point is being reached.

In Q2, Gartner says worldwide smartphones sales rose 46.5% from the year earlier quarter to hit 225 million units shipped, while sales of feature phones declined 21% year-on-year to 210 million units. Smartphone shipments grew most in Asia Pacific, Latin American and Eastern Europe, with growth rates of 74.1%, 55.7% and 31.6% respectively, but the analyst said sales grew in all regions. IDC‘s recent market figures put Android on approaching 80% worldwide marketshare for Q2. Google’s mobile OS is clearly expanding its share by picking up former feature phone users.

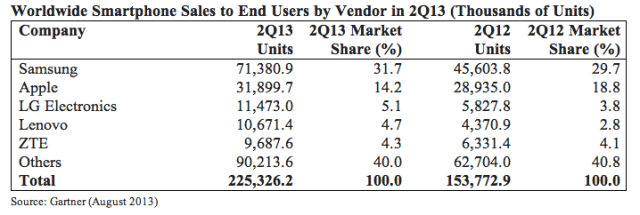

The rising tide of global smartphone ownership is raising all boats, but Samsung continues to dominate the smartphone landscape. Gartner said Samsung grew its share to approaching a third (31.7%), up 29.7% on Q2 2012. Apple also grew shipments of its iPhone but its marketshare declined — highlighting the case for Cupertino to make a low cost iPhone to capture growth at the budget end of the market. Apple took a 14.2% share in Q2, 2013, vs 18.8% in the year ago quarter. It still shipped 10.2% more iPhones vs Q2 2012 but is being outpaced by higher smartphone market growth rates.

After Samsung and Apple, it’s a tale of all Asian smartphone makers battling for third place: LG grabbed third place in Q2 (with a 5.1% share); followed by Lenovo (4.7%) whose Lephone has been a popular seller in China; and ZTE (4.3%).

In Q2, Gartner says worldwide smartphones sales rose 46.5% from the year earlier quarter to hit 225 million units shipped, while sales of feature phones declined 21% year-on-year to 210 million units. Smartphone shipments grew most in Asia Pacific, Latin American and Eastern Europe, with growth rates of 74.1%, 55.7% and 31.6% respectively, but the analyst said sales grew in all regions. IDC‘s recent market figures put Android on approaching 80% worldwide marketshare for Q2. Google’s mobile OS is clearly expanding its share by picking up former feature phone users.

The rising tide of global smartphone ownership is raising all boats, but Samsung continues to dominate the smartphone landscape. Gartner said Samsung grew its share to approaching a third (31.7%), up 29.7% on Q2 2012. Apple also grew shipments of its iPhone but its marketshare declined — highlighting the case for Cupertino to make a low cost iPhone to capture growth at the budget end of the market. Apple took a 14.2% share in Q2, 2013, vs 18.8% in the year ago quarter. It still shipped 10.2% more iPhones vs Q2 2012 but is being outpaced by higher smartphone market growth rates.

After Samsung and Apple, it’s a tale of all Asian smartphone makers battling for third place: LG grabbed third place in Q2 (with a 5.1% share); followed by Lenovo (4.7%) whose Lephone has been a popular seller in China; and ZTE (4.3%).

Gartner said Apple saw a significant drop in the average selling price (ASP) of its devices in Q2, with its ASP declining to the lowest figure registered by Apple since the iPhone’s launch in 2007. This is down to strong sales of the iPhone 4 — again underlining the case (from a volume perspective) for Apple to launch a cheaper iPhone. However doing so would clearly accelerate that decrease in its ASP, even if market growth is now being powered by budget devices — providing the impetus for Apple to expand the iPhone to cheaper price-points still.

“While Apple’s [declining] ASP demonstrates the need for a new flagship model, it is risky for Apple to introduce a new lower-priced model too,” commented Gartner analyst Anshul Gupta in a statement. ”Although the possible new lower-priced device may be priced similarly to the iPhone 4 at $300 to $400, the potential for cannibalisation will be much greater than what is seen today with the iPhone 4. Despite being seen as the less expensive sibling of the flagship product, it would represent a new device with the hype of the marketing associated with it.”

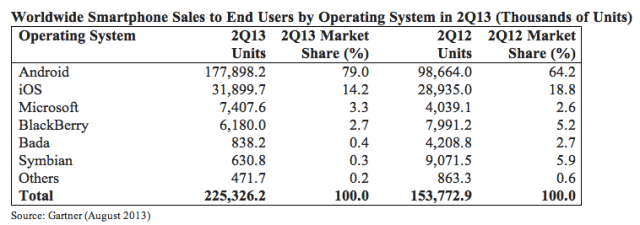

Also noteworthy in Q2, Microsoft’s Windows Phone platform pushed past BlackBerry’s OS for the first time to take third place. When Windows Phone launched, back in 2010, Steve Ballmer and Nokia’s CEO Stephen Elop talked of their ambition to create a third ecosystem in the smartphone space. They’re still trying to stock the fires of an ecosystem but are at least in third place from a sales perspective.

Windows Phone took a 3.3% global market share in Q2 vs just 2.7% for the struggling BlackBerry OS. Gupta, noted: “While Microsoft has managed to increase share and volume in the quarter, Microsoft should continue to focus on growing interest from app developers to help grow its appeal among users.”

Taken together, Android and iOS took a 93.2% global marketshare in the quarter — underlining why developers opt to support these two platform first and foremost, and generally require incentives to expend effort elsewhere. Android’s global marketshare in Q2 was a staggering 79% according to Gartner, up from 64.2% in the year ago quarter — buoyed by feature phone switchers.

“While Apple’s [declining] ASP demonstrates the need for a new flagship model, it is risky for Apple to introduce a new lower-priced model too,” commented Gartner analyst Anshul Gupta in a statement. ”Although the possible new lower-priced device may be priced similarly to the iPhone 4 at $300 to $400, the potential for cannibalisation will be much greater than what is seen today with the iPhone 4. Despite being seen as the less expensive sibling of the flagship product, it would represent a new device with the hype of the marketing associated with it.”

Also noteworthy in Q2, Microsoft’s Windows Phone platform pushed past BlackBerry’s OS for the first time to take third place. When Windows Phone launched, back in 2010, Steve Ballmer and Nokia’s CEO Stephen Elop talked of their ambition to create a third ecosystem in the smartphone space. They’re still trying to stock the fires of an ecosystem but are at least in third place from a sales perspective.

Windows Phone took a 3.3% global market share in Q2 vs just 2.7% for the struggling BlackBerry OS. Gupta, noted: “While Microsoft has managed to increase share and volume in the quarter, Microsoft should continue to focus on growing interest from app developers to help grow its appeal among users.”

Taken together, Android and iOS took a 93.2% global marketshare in the quarter — underlining why developers opt to support these two platform first and foremost, and generally require incentives to expend effort elsewhere. Android’s global marketshare in Q2 was a staggering 79% according to Gartner, up from 64.2% in the year ago quarter — buoyed by feature phone switchers.

The drop off in feature phone sales is bad news for Nokia, which still leans heavily on its feature phone business (being as its smartphone business is tied to the Windows Phone underdog). Nokia shipped just 61 million feature phones in Q2, down from 83 million in the year ago quarter. But the Finnish mobile maker is at least seeing some decent growth in smartphones, thanks to having a broader portfolio of devices to offer at different price points. Nokia’s Windows Phone-powered Lumia sales grew 112.7% in Q2 2013, according to Gartner.

0 التعليقات:

Post a Comment